France is often associated with gastronomy, art and fashion. Surprisingly enough, the wine & cheese country accounted for 29% of the overall number of LegalTech companies around the world in 2019. LegalTech is a part of a bigger field known as NewLaw. NewLaw refers to the law firms, businesses or start-ups that use a model, tool or process to substantially modify the distribution of legal services. NewLaw companies are defined by their flexibility, client-focused perspective and alternative pricing.

NewLaw being a relatively new and extensive concept, it is currently undergoing an inevitable division into categories. Those categories are, broadly, (i) automation and artificial intelligence (AI), (ii) alternative staffing through Alternative Legal Services Providers (ALSP), (iii) legal process outsourcing (LPO) and (iv) remote-working tools. The first one encompasses all the businesses that aim to automate the drafting of legal acts and the management of both data and the lawyer’s administrative work. The second one refers to the cost-effective freelance employment of lawyers aimed at helping with overflow work or assisting on specific projects. The third one concerns the legal support services that firms and businesses reach out for from outside law firms or legal support services companies, often significantly saving costs by hiring foreign lower priced lawyers. And the last one involves the software or platforms that enable physical work such as the secure exchange of legal documents to be performed remotely.

Around the world, the market of NewLaw is in tremendous expansion. A Thomson Reuters study from 2019 found that the market of ALSPs was worth 10.7 billion USD and a Zion Market Research study from 2018 found that the market of LegalTech using AI was worth 3.245 billion USD. While LegalTech is embodied in NewLaw, a NewLaw firm/business does not necessarily make use of revolutionary technology as long as it is basically modifying the way it is run or the way it delivers its services. Looking at France specifically, it appears that the wave that is disrupting the legal market is mainly one of technological changes aimed at automating documents and processes, leaving aside the considerable markets of ALSPs and LPOs that intend to remodel the way the legal profession delivers its services. Many questions arise. How are NewLaw and LegalTech developing in France compared to other countries? Is there space for them in the French legal market? How early or late are they?

Today, 51% of law firms and 60% of corporate legal departments globally are using an ALSP. Whether they are a Big Four, a law firm, an LPO or a managed services or contract and staffing services business, they are drastically changing the client-lawyer relationship. In the US, the UK, Canada, Israel, Hong Kong, Australia, or even New-Zealand, these companies have already proven themselves, convinced and conquered.

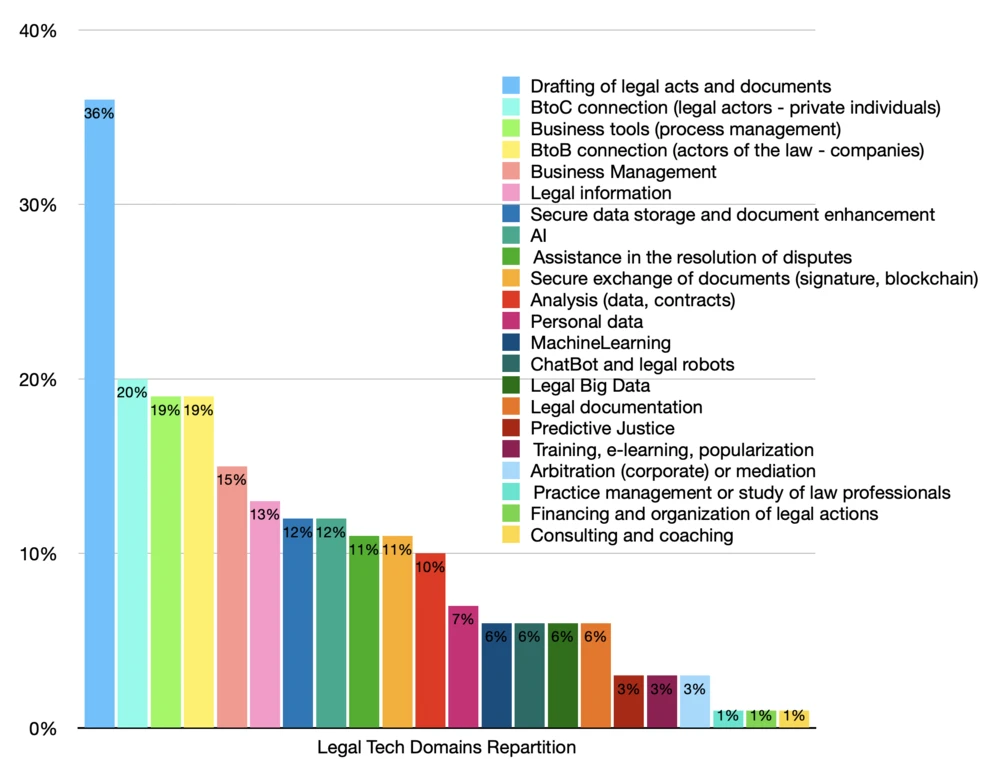

Here is what is happening in France. First of all, it is undeniable that a major will for innovation emerged in the French legal sphere over the last decade. However, whether that will really came to fruition or not is a legitimate question. As a matter of fact, from 7 start-ups in 2012, the market grew to more than 300 today and investments in the sector escalated from €13 million in 2017 to €52 million in 2019. One might say that, although young, the market in France seems very promising. However, after its first few years, the pace of creation of LegalTech slowed down. Whether that means that real innovations are not infinite or that the market is not as ready or as filled with opportunities as one would hope is unanswered. Yet what is clear is where the majority of the market is headed. The following figure summarises the breakdown of the French Legal Tech start-ups by field:

It appears that the focus is, for now, on the automatization of documents’ drafting. Moreover, a substantial interest in the online connection between legal actors and both individuals and professionals appeared. Many start-ups such as Call a Lawyer, Avoloi, VisioAvocats, Izilaw, LegaLife, Captain Contrat or LegalPlace emerged. They basically all offer to find a lawyer to obtain legal advice through different means (using AI, a video-conference platform, a phone or a software). However, out of all these start-ups, either the lawyer’s work is a secondary offer – added to documents’ drafting for example – or the start-up only aims to market lawyers online and establish a first contact with them (the end service is not necessarily cheaper).

What about the other segments of NewLaw? The ALSP market that allows law firms and businesses to temporarily expand their legal capacity and boost their expertise on demand, as well as the LPO market that allows them to outsource their legal work, both of which are significantly lowering their costs, do not seem to have emerged in France yet.

Perhaps there is a cultural explanation to this absence. On one hand, the governmental context gives the impression that it is favourable to and supportive of both technological innovation and a modernisation of the legal practice. Indeed, the 2015 ‘Macron Law’, also called the ‘law on economic growth, activity and equal opportunities’, aims at simplifying administrative procedures and encouraging entrepreneurship and innovation through different practical economic measures. It thus provides new possibilities for lawyers to offer professional advice while organising their resources with flexibility and collaborating with other lines of work. The French Legal Tech task force was even created within France Digitale, an association representing nearly 1,400 French digital start-ups and investors, to pool skills and experience in order to respond to the international competition that is on the horizon. On the other hand, some remaining deficiencies have limited those steps forward. These deficiencies are notably the anchored administrative burden, the archaic attribute of Law, the lawyers’ perception of NewLaw as a threatening rival, the moderate capacity of VC investment or even the struggle to retain talents in the country.

Be that as it may, everything has changed over the last few months globally. Needless to say, the COVID19 crisis has introduced or reinforced the universal idea that remote work allows for the accomplishment of equal or better performance. We are also entering one of the biggest economic crises ever witnessed. This translates into budget cuts and higher demand for lower cost alternatives around the world. This is why companies such as the American Axiom, the British Lawyers on Demand or the Israeli Lawflex, a Law Company that has 400+ lawyers from 24 jurisdictions on its bench and currently setting up in France, are about to provide the solution to a problem that has existed for too long. Those alternative staffing companies provide easy access to vetted legal talent on a project basis to gain in efficiency, access specialized expertise and reduce costs.

While all sectors started witnessing a revolution regarding the use of technology, it was obvious that the field of law would not be spared. What is looked at as the foundation of society, defined by traditions and conventions, found itself on the path of change and modernisation. This is why the French legal market is ready. Ready for businesses such as Lawflex to answer a research for more efficient, client-focused, financially attractive while high-quality lawyers that work flexibly. And lawyers finally have a right to a healthy work-life balance. There doesn’t seem to be any flaws to the progress the world of law is going through, and France is starting to realize it!

![“[NewLaw] is currently undergoing an inevitable division into categories.”](https://lawflex-latam.com/wp-content/uploads/2020/08/NewLaw-is-currently-undergoing-an-inevitable-division-into-categories..webp)